How to Use your ISO 9001 Accreditation to Grow Your Business

Whatever the reasons for seeking compliance and certification, many organisations fail to capitalise on the potential benefits that ISO 9001 accreditation can bring. These organisational benefits can include process improvements, reputation benefits, and cost savings, as well as ensuring consistency of product and delivering customer satisfaction. MAKING THE MOST OF ISO 9001 The sooner an ... Read more How to Use your ISO 9001 Accreditation to Grow Your Business

How to Achieve continuous growth and improvement

Within today's Quality Management Systems, ‘Continuous Improvement’ is one of the most important principles, especially within the ISO 9001:2015 Quality Management System. It plays an important part in keeping the organisation competitive, and must be a permanent objective within the organisation. In reality, history shows that many organisations go out of business simply because they ... Read more How to Achieve continuous growth and improvement

The importance of correctly managing your team

Many businesses, no matter what the size, forget their most important asset. Their staff! It’s not easy when you, as a business owner, CEO or General Manager, are constantly trying to balance profit and loss, fight suppliers or chase debtors to remember that there is a team below you waiting for leadership, decisions and support. ... Read more The importance of correctly managing your team

Affiniax Participates in Dubai Chamber Sustainability Week 2020

Affiniax Partners was one of the 51 participants of the Dubai Chamber Sustainability Week 2020 Campaign from 18th October - 5th November. We actively organized sessions to create a healthy and happy atmosphere for our employees. We organized an in-house virtual Hatha Yoga session to kick off this campaign. Yoga session was followed by the ... Read more Affiniax Participates in Dubai Chamber Sustainability Week 2020

LIQUIDATIONS IN THE UNITED ARAB EMIRATES (PART 1)

INTRODUCTION Liquidation can be defined as the winding up of a Company by selling off its assets to convert them into cash to pay off the firms unsecured creditors. The secured creditors take control of the respective pledged assets on obtaining foreclosure orders. Any remaining amount is distributed among the shareholders in proportion to their ... Read more LIQUIDATIONS IN THE UNITED ARAB EMIRATES (PART 1)

LIQUIDATIONS IN THE UNITED ARAB EMIRATES (PART 2)

In my previous article, titled, Liquidations in the United Arab Emirates (Part 1), we came across the roles, and duties of a Liquidator, the necessary documents required and the different types of Liquidations in the UAE. We now take a look at the Procedures for Liquidation. Mainland Company In case of a mainland Company the following ... Read more LIQUIDATIONS IN THE UNITED ARAB EMIRATES (PART 2)

NEW UAE CABINET RESOLUTION – COMPANIES TO MAINTAIN BENEFICIAL OWNERSHIP REGISTER

The United Arab Emirates (UAE) recently issued Cabinet Resolution No. 58 of 2020 on the Regulation of the Procedures of the Real Beneficiary (the Resolution), which came into effect on 28 August 2020 and replaced Cabinet Resolution No. 34 of 2020 issued earlier this year. Over the years, certain free zones in Dubai have already ... Read more NEW UAE CABINET RESOLUTION – COMPANIES TO MAINTAIN BENEFICIAL OWNERSHIP REGISTER

Affiniax Partners’ HR Rising Star

Beginning I chose the Human Resources discipline for my MBA as I wanted to have a positive impact on people’s lives through the introduction of employee-friendly policies, influence future aspects of the company based on my recruitment decisions, and help organizations identify key talent. My Ongoing HR Journey… Oct 2017 - I began my HR ... Read more Affiniax Partners’ HR Rising Star

Principles to keep in mind while preparing a Combined Financial Statement or Consolidated Financial Statement

If you are an owner of multiple businesses or the majority shareholder of a Company which is part of a group and is under a parent / subsidiary relationship, it's important to understand your options when it comes to preparation of financial statements and reporting for stakeholders. Being an owner of the Company / group, ... Read more Principles to keep in mind while preparing a Combined Financial Statement or Consolidated Financial Statement

What Safety Measures Restaurants should take during the COVID-19 Pandemic

After months of being stuck at home during lockdown, even the most experienced home chef would be longing for a meal that he or she did not labour to make in their kitchen. For some, a reason to change out of their sleepwear and get out of the house—with or without the kids—is becoming more ... Read more What Safety Measures Restaurants should take during the COVID-19 Pandemic

Is it Safe to Travel Once Again?

Is it safe to travel once again? What is being done at the moment to make it safe to travel once more? Despite the health risks and economic slowdown, travelling between cities or countries cannot be completely avoided. The travel and tourism industry is no doubt one of the hardest hit, if not the hardest ... Read more Is it Safe to Travel Once Again?

UAE Economic Substance Regulation ESR: Major Overhaul

The United Arab Emirates (“UAE”) Cabinet of Ministers issued Cabinet Resolution No. 57 of 2020 on 10 August, 2020. This resolution replaced the original Cabinet Resolution No.31 of 2019 (the original ESR law) concerning the Economic Substance Regulation (“ESR”). The UAE Ministry of Finance has now also updated its website with further information regarding the ... Read more UAE Economic Substance Regulation ESR: Major Overhaul

How to improve Cash Flow Management during COVID-19

A couple of months ago, we wrote a blog describing "WHY BUDGETING IS CONSIDERED KEY TO BUSINESS FINANCIAL SUCCESS?” and one of the mentioned benefits of budgeting was planning and predicting cash flows. We assume that, due to the unpredictable events caused by COVID-19, there would be a major change in the budgeted figures and ... Read more How to improve Cash Flow Management during COVID-19

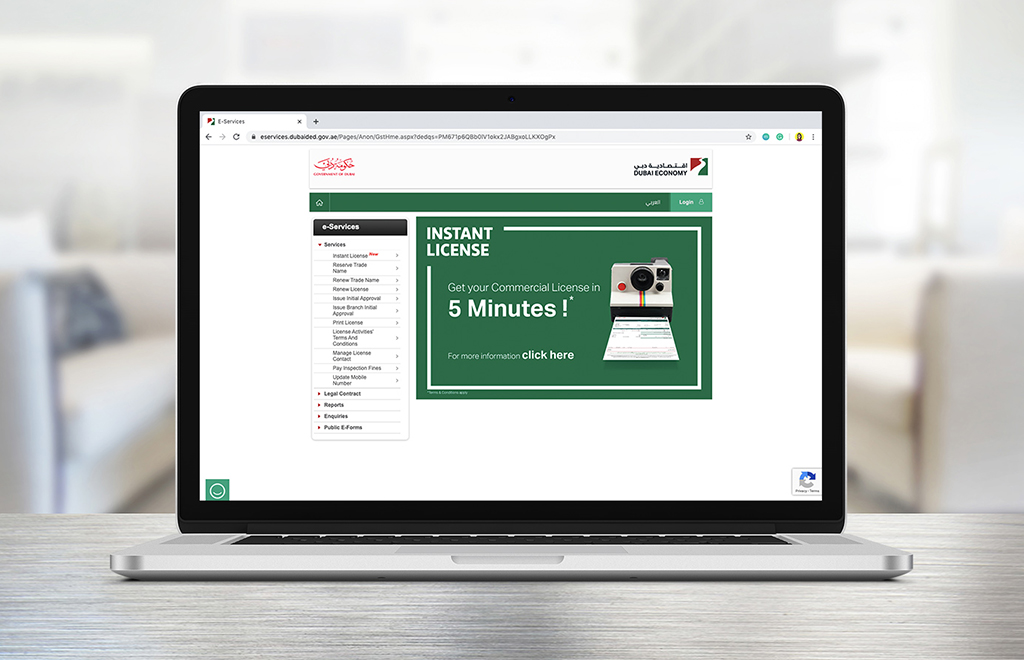

Instant License in Dubai

What is an Instant License? The Instant License is a trade license available to those intending to carry out commercial or professional business activities and can be obtained within minutes. For an instant license, you do not need to submit following documents to the Dubai Economy (DED): Memorandum of Association Office Tenancy Contract It is ... Read more Instant License in Dubai

COVID-19: Accounting and Financial Reporting Considerations

The outbreak of the Coronavirus (COVID-19) pandemic has had an adverse impact on the global economy and is affecting businesses of all sizes and sectors. Organizations around the world are facing challenges, often related to economic downturns, such as supply chain disruption, reduction in revenue, increasing inventory level, business closures, delay in expansion and tightening ... Read more COVID-19: Accounting and Financial Reporting Considerations

Key Steps accountants should take to guide SMEs out of the Covid-19 Crisis

In the present situation where the whole world has come to a stop, it is now more important than ever to have savings in hand. There will be a massive impact felt due to the coronavirus, and businesses need to be ready for any situation which comes their way. It is because of this reason ... Read more Key Steps accountants should take to guide SMEs out of the Covid-19 Crisis

Accounting For COVID-19-Related Rent Concessions

COVID-19-Related Rent Concessions for Lessees, published by IASB on May 28, 2020: Purpose: As a result of the COVID-19 pandemic, many lessors are providing rent holidays / concessions to lessees. Rent Concessions can be in the form of rent waivers, lease payment deferrals or one-off rent reductions. Prior to the amendment, such concessions may fall ... Read more Accounting For COVID-19-Related Rent Concessions

ESR Filing Deadlines

For ease of reference we have set out below details of the requirements to notify as communicated by the selected regulatory authorities, together with the deadline: Regulatory Authority Who is required to file Deadline ADGM Only entities/ licensees that are carrying out relevant activity By 30 June 2020 DAFZ All entities/ licensees, including those who do not undertake relevant activity ... Read more ESR Filing Deadlines

Accounting of Unexpected COVID-19 related Costs

HOW TO ACCOUNT FOR UNEXPECTED COSTS RELATED TO COVID-19 COVID -19 has taught us a new lifestyle as well as new business structures. Staying at home and social distancing is becoming a part of our day-to-day life. Every business and every person has been affected by this epidemic and it will go down in history ... Read more Accounting of Unexpected COVID-19 related Costs

Accounting Technologies

Accountants need to stay up to date with technological advances in order to respond to market conditions and their clients' needs. Technological innovations have led the way, establishing how accounting is done nowadays. Digital resources and online tools help improve productivity and organization. Now, we can find advanced technology to help streamline accounting processes and ... Read more Accounting Technologies

DMCC Launches Employee Protection Scheme

Dubai Multi Commodities Centre (DMCC), in collaboration with Dubai Insurance Company (DIC) have launched a new “Employee Protection Insurance (EPI) Programme” to provide more comprehensive benefits for all DMCC and member company employees. The said programme will offer increased protection for DMCC employees in the event their employers default on salaries, gratuity or repatriation cost. ... Read more DMCC Launches Employee Protection Scheme

Dubai South Announces Economic Stimulus Package

To lighten the effects of the current situation in the United Arab Emirates (UAE) and the world due to the coronavirus, Dubai South Free Zone announced several economic stimulus incentives. The stimulus package is a part of the UAE Leadership’s vision to stimulate the economy and support different sectors of the business society so that ... Read more Dubai South Announces Economic Stimulus Package

E-commerce Business Setup in United Arab Emirates

E-commerce means buying and selling of goods, products or services over the internet. E-commerce is also known as electronic commerce or internet commerce. These services are provided online over the internet. Transaction of money, funds and data are also considered to be E-commerce. While it is not new, this sector is growing rapidly across the ... Read more E-commerce Business Setup in United Arab Emirates

GUIDELINES FOR DMCC MEMBER ENTITY OFFICES AS PER COMPANY REGULATIONS 2020

In line with the new rules and regulations set out on 2nd January 2020, DMCC has introduced guidelines to define the roles and responsibilities of DMCC member entities, who are required to comply with the following changes. Officer Designation Applicable Rules Director Appointment of Director is mandatory for all Companies except Branches entities. There is ... Read more GUIDELINES FOR DMCC MEMBER ENTITY OFFICES AS PER COMPANY REGULATIONS 2020

Economic Substance Regulations – Deadlines Announced so far

The UAE Economic Substance Regulations (ES Regulations) require all UAE entities that fall within the scope of the regulations by carrying on a “relevant activity” as defined by the ES Regulations to comply with annual reporting obligations. Due to the current pandemic and subsequent lockdown, several Free Zone Regulatory Authorities have extended the last date ... Read more Economic Substance Regulations – Deadlines Announced so far

DMCC and DED announce 2 new Services

Introducing New Services from DMCC in Partnership with DED Last year, Dubai Multi Commodities Centre Authority (DMCC) – the world’s flagship Free Zone and the Department of Economic Development (DED), the entity of the Government of Dubai that regulates the economic activity of all onshore companies, signed a strategic agreement to collaborate on the licensing ... Read more DMCC and DED announce 2 new Services

RAS AL KHAIMAH ECONOMIC ZONE (RAKEZ) BUSINESS SECURE PACKAGE

As part of RAKEZ’s commitment to offer a cost effective and world class economic zone, RAKEZ has introduced a Business Secure package that would help support individuals in the UAE to start afresh, embark on their entrepreneurial journey and turn the current challenges into an opportunity. The Business Secure Package Includes: 1-year license and establishment ... Read more RAS AL KHAIMAH ECONOMIC ZONE (RAKEZ) BUSINESS SECURE PACKAGE

Business Continuity

The current global scenario has hampered the growth of the economy and stability with almost all sectors facing a decline as a result of Covid 19. Although this has only started to emerge, the extent of this will be noticed in the upcoming months. The spread of the virus is causing different impacts in each ... Read more Business Continuity

DMCC Business Support Package

Dubai Multi Commodities Center (DMCC), the world’s flagship Free Zone and Government of Dubai on commodities trade and enterprise has recently announced the roll out of a “Business Support Package”, to support and safeguard the business interests of its members during these difficult times. Effective from 1st April to 30th June 2020, existing DMCC members … Read more DMCC Business Support Package

Why set up a business in Hamriyah Free Zone?

Established on November 12. 1995, the Hamriyah Free Zone is home to more than 6,500 businesses from 163 countries. In addition to world-class facilities including offices, warehouses, factories and executive office suites, Hamriyah Free Zone also has over 15 on-site key business services, like banking and auditing firms, currency exchanges, conference rooms, staff accommodation, and ... Read more Why set up a business in Hamriyah Free Zone?

Why Outsource Bookkeeping and Accounting Function?

Every business is different and one business’ proven formula may not fit another’s. It is very important for a Company to maintain its financial discipline, irrespective of the nature or size of the business. Some of the key benefits of outsourcing finance operations are: Saves time – One of the most common and obvious advantages … Read more Why Outsource Bookkeeping and Accounting Function?

NEWLY INTRODUCED, RAK ICC FOUNDATIONS

With the continuous vision to achieve global brand recognition as a premium jurisdiction for the provision of Company formation services, Ras Al Khaimah International Corporate Centre has recently introduced its new product, the RAK ICC Foundation. The RAK ICC Foundation is a corporate body created with a legal personality separate from that of its Founder(s) … Read more NEWLY INTRODUCED, RAK ICC FOUNDATIONS

DMCC – NEW RULES & REGULATIONS TO ENHANCE EASE OF DOING BUSINESS

Dubai Multi Commodities Centre (DMCC) – the region’s leading trade hub– has announced a set of new rules and regulations effective from 2nd January, 2020 which aims to further increase the ease of doing business for new and existing DMCC member companies. The new regulations were developed following extensive data gathering and stakeholder engagement along with the consultation … Read more DMCC – NEW RULES & REGULATIONS TO ENHANCE EASE OF DOING BUSINESS

SUBMISSION OF CBCR NOTIFICATION TO MOFA

All multinational groups with Group Revenue equal to or exceeding 3.15 Billion AED must read this carefully. Otherwise, there is a risk of AED 1,000,000 penalty if the form is not submitted by 31 December 2019. Ministry of Finance (MoF) has required all eligible entities to submit CbCR notifications before the 31 December 2019 deadline. The purpose of … Read more SUBMISSION OF CBCR NOTIFICATION TO MOFA

PHISHING ALERT: UAE VAT

“We are aware that a number of clients have been sent emails and letters from fraudsters pertaining to be the Federal Tax Authority or Banks and requesting for certain details from them. The Federal Tax Authority would generally only communicate with registrants through emails from the domain tax.gov.ae sent to the registered email address, or via your eservices.tax.gov.ae portal … Read more PHISHING ALERT: UAE VAT

ROLE OF AN ACCOUNTANT IN BUSINESS OPERATIONS

An accountant can be anything from a simple bookkeeper to a strategic advisor, interpreting financial information for senior decision-makers in the business. Financial Data Management The accounting structure of a company is an essential component of business operations. One of the primary roles of an accountant usually involves the collection and maintenance of financial data, … Read more ROLE OF AN ACCOUNTANT IN BUSINESS OPERATIONS

What is an IT Audit?

An information technology audit, or information systems audit, is an examination of the management controls within an Information Technology (IT) infrastructure. The evaluation of obtained evidence determines if the information systems are safeguarding assets, maintaining data integrity, and operating effectively to achieve the organisation’s goals or objectives. These reviews may be performed in conjunction with … Read more What is an IT Audit?

WHY INTERNAL AUDIT? IS IT WORTH AN ADDITIONAL COST TO YOUR COMPANY?

In order to understand the term ‘Internal Audit’, lets first understand what an “Internal control system” is. Internal control system means the policies and procedures adopted by the management of an entity to assist in achieving management’s objective of ensuring orderly and efficient conduct of its business. It includes reliability of management policies, safeguarding of … Read more WHY INTERNAL AUDIT? IS IT WORTH AN ADDITIONAL COST TO YOUR COMPANY?

PRINCIPLES OF TRANSFORMATIONAL LEADERSHIP

When we talk about ‘Leadership’, what is the first thing that comes to your mind? An Executive, busy developing a Company’s strategy to compete in the market; or a Political leader pursuing his passion; or maybe an Explorer, cutting a path through a dense jungle for the rest of his group to follow. One thing … Read more PRINCIPLES OF TRANSFORMATIONAL LEADERSHIP

WHY BUDGETING IS CONSIDERED KEY TO BUSINESS FINANCIAL SUCCESS?

One of the most important tools an entrepreneur can develop for the financial success of a business is a budget. Budgets allow a business owner to not only plan for expenses, but also analyze expenditures and make changes according to the needs of the enterprise. A business that doesn’t budget sets itself up for a ... Read more WHY BUDGETING IS CONSIDERED KEY TO BUSINESS FINANCIAL SUCCESS?

OUTSOURCED CFO SERVICES

Case Study We were recently approached by a mid-sized Events Management Company having a successful track record across several GCC countries. The Company performed much better than the young entrepreneurs had expected in a short span of time. Due to the inherent nature of their business, most of the revenue was collected in advance, thus … Read more OUTSOURCED CFO SERVICES

NEW LAW GOVERNING JOINTLY OWNED PROPERTIES IN DUBAI

The Law No. (6) of 2019* regarding Ownership of Jointly Owned Properties in the Emirate of Dubai has been issued to regulate the joint ownership of real estate in Dubai. The Law applies to all major real estate development projects and jointly owned properties in Dubai, including those located in free zones and special development … Read more NEW LAW GOVERNING JOINTLY OWNED PROPERTIES IN DUBAI

HOW CLOUD-BASED ACCOUNTING CAN BENEFIT YOUR BUSINESS

Would you have been interested in a “cloud based” accounting application only a few years ago? Probably not. Majority of small business owners are still trying to wrap their heads around the traditional accounting system wherein you hire an accountant on a payroll rather than a scary thought of outsourcing the accounting and trusting someone … Read more HOW CLOUD-BASED ACCOUNTING CAN BENEFIT YOUR BUSINESS

OFFSHORE COMPANIES IN THE UNITED ARAB EMIRATES

An ‘Offshore Company’ is a type of legal business entity available for businesses looking to establish in the UAE with the intention of either operating outside the UAE or for the purposes of acting as a holding company (for example for the purposes of holding Real Estate, Intellectual Property Rights, Shares in other Operating Businesses … Read more OFFSHORE COMPANIES IN THE UNITED ARAB EMIRATES

FTA WARNS BUSINESS OWNERS OVER VAT REFUND SCAM

The UAE’s Federal Tax Authority has issued a warning to business owners to be wary of phishing emails from scammers. The new scam came to light after emails were sent to customers of local banks requesting their personal banking details so that their VAT refund can be processed. The Authority has revealed that some bank … Read more FTA WARNS BUSINESS OWNERS OVER VAT REFUND SCAM

PROCEDURE FOR VAT REFUND IN DUBAI – FOREIGN BUSINESSES

The 6 months deadline for VAT Refund for Foreign businesses is expiring on 1 October 2019. The refund scheme for the calendar year 2018 started from 2 April 2019. For the calendar year 2019, the refund scheme will start from 1 March 2020 and will last till 31 August 2020. As a special exception, the … Read more PROCEDURE FOR VAT REFUND IN DUBAI – FOREIGN BUSINESSES

SHARJAH MEDIA CITY FREE ZONE- AN EMERGING NAME IN THE U.A.E BUSINESS MARKET

Why Sharjah? Sharjah, the third largest emirate in the UAE, lies partly on the Persian Gulf and partly on the eastern coast of the Gulf of Oman. It is positioned between Asia, Europe and Africa, making it a strategic location with access to markets which total more than 3 billion people. ‘Rising Sun’, as the … Read more SHARJAH MEDIA CITY FREE ZONE- AN EMERGING NAME IN THE U.A.E BUSINESS MARKET

DLD and RERA Introduce New Service For Real Estate Stakeholders in Dubai

The Dubai Land Department (DLD), through the Real Estate Regulatory Agency (RERA), has launched an innovative electronic system called Mollak, an innovative, electronic web-based service developed by RERA for the purpose of registering Owners’ Associations and the Management Companies forming part of a Jointly Owned Property. Mollak, which means “owner” in Arabic, is developed specifically … Read more DLD and RERA Introduce New Service For Real Estate Stakeholders in Dubai

OWN FREEHOLD PROPERTIES IN DUBAI WITHOUT A DUBAI LICENSE FOR RAKICC REGISTERED COMPANIES

Dubai Land Department (DLD) strengthen ties with Ras Al Khaimah International Corporate Centre (RAKICC) by signing Memorandums of Understanding (MOU) for the registration of freehold properties in Dubai. With this, there is no need for RAKICC Registered Companies to obtain a Dubai trade/commercial license to own a property in Dubai. No objection Certificate from RAKICC … Read more OWN FREEHOLD PROPERTIES IN DUBAI WITHOUT A DUBAI LICENSE FOR RAKICC REGISTERED COMPANIES

DMCC INTRODUCES DUAL LICENSING SCHEME BY PARTNERING WITH DED

As part of a continuous effort to transform Dubai into an investment friendly ecosystem, Dubai Multi Commodities Centre (DMCC), the world’s flagship Free Zone and Government of Dubai Authority on commodities trade and enterprises, and the Department of Economic Development (DED), the Government of Dubai entity that regulates the economic activities of all onshore companies, … Read more DMCC INTRODUCES DUAL LICENSING SCHEME BY PARTNERING WITH DED

100% FOREIGN OWNERSHIP IN THE UAE FOR CERTAIN ACTIVITIES

His Highness Shaikh Mohammad Bin Rashid Al Maktoum chairman of the UAE cabinet, Vice President, Prime Minister and Ruler of Dubai has approved the sectors and economic activities eligible for up to 100% foreign ownership in the UAE. Total of 122 economic activities across 13 sectors were specified to be entitled for up to 100% … Read more 100% FOREIGN OWNERSHIP IN THE UAE FOR CERTAIN ACTIVITIES

WHY INVEST IN THE UNITED ARAB EMIRATES?

Introduction: United Arab Emirates The UAE’s status as a growing knowledge hub is enhancing its attractiveness as a business destination that offers a multitude of possibilities. There are more than 40 free trade zones in UAE which offer business stability and 100% foreign ownership. The taxation regime is extremely appealing with 0% Corporate Income Tax … Read more WHY INVEST IN THE UNITED ARAB EMIRATES?

DOUBLE TAX TREATY: INDIA & UNITED ARAB EMIRATES

The Double Tax Treaty between UAE and India was signed in 1989 and later amended through notifications of 1993, 2001, 2007 & 2013. Double taxation is defined when similar taxes are imposed in two countries on the same taxpayer on the same tax base, which harmfully affects the exchange of goods, services and capital and … Read more DOUBLE TAX TREATY: INDIA & UNITED ARAB EMIRATES

TRANSFER PRICING AND UNITED ARAB EMIRATES

Transfer Pricing (TP) is a practice that allows for pricing transactions internally within businesses and between companies that operate under common control or ownership, including cross border transactions. The United Arab Emirates (“UAE”) joined the OECD Inclusive Framework on Base Erosion and Profit Shifting (“BEPS”) on 16 May 2018. Through joining the Inclusive Framework, the … Read more TRANSFER PRICING AND UNITED ARAB EMIRATES

Affiniax Partners joins Allinial Global

Affiniax Partners is very pleased to announce it has joined Allinial Global (formerly PKF North America), a member-based association that has dedicated itself to the success of independent accounting and consulting firms since its founding in 1969. Allinial Global is based in North America but offers international support by connecting its firms to providers and … Read more Affiniax Partners joins Allinial Global

KINGDOM OF SAUDI ARABIA AND UNITED ARAB EMIRATES DOUBLE TAX TREATY – OFFICIAL PUBLICATION

In its official gazette (Umm Al-Qura) the Kingdom of Saudi Arabia (KSA) on 1 March 2019 published its Double Tax Treaty (DTT) with the United Arab Emirates. This marks the first DTT among the Gulf Cooperation Council (GCC) countries. It is considered as the foundation for the accelerated cross-border trade between these two countries. The … Read more KINGDOM OF SAUDI ARABIA AND UNITED ARAB EMIRATES DOUBLE TAX TREATY – OFFICIAL PUBLICATION

NEW JAFZA OFFSHORE REGULATIONS

New JAFZA Offshore Regulations The Jebel Ali Free Zone Authority (JAFZA) recently published new Regulations for Jebel Ali Offshore Companies, which will replace the current regulations that were introduced in 2003. The implementation date for the new Regulations are not implemented yet but it will be announced soon. New regulations with several benefits for international … Read more NEW JAFZA OFFSHORE REGULATIONS

IMPLEMENTATION OF CBCR IN UAE

Preamble United Arab Emirates committed to the implementation of ‘minimum standards’ to prevent Base Erosion Profit Shifting (BEPS) by joining OECD’s Inclusive Framework on BEPS on 16th May 2018. Minimum Standards on BEPS & UAE’s progress Action 5: Countering Harmful Tax Practices More Effectively, Considering Transparency and Substance. UAE Progress: Application of a VAT system including … Read more IMPLEMENTATION OF CBCR IN UAE

Dubai International Financial Centre Introduces New Licensing Categories

Dubai International Financial Centre (DIFC) is the leading financial capital in the Middle East, Africa and South Asia (MEASA) region. As one of Dubai’s independent free-zones, with its own legal and regulatory framework and judicial system, global financial exchange, tax-friendly regime, and a large business community, DIFC is persistent in supporting its businesses to grow … Read more Dubai International Financial Centre Introduces New Licensing Categories

THE BENEFITS OF MOVING TO A CLOUD ACCOUNTING PLATFORM IN THE UAE

The benefits of moving to a cloud accounting platform in the UAE The world we live in is rapidly moving towards digital for all aspects of business, one of the most aggressive moves is that of the accounting world. With your company’s financials at stake, what are the real benefits of moving to a cloud … Read more THE BENEFITS OF MOVING TO A CLOUD ACCOUNTING PLATFORM IN THE UAE

OBTAINING TAX RESIDENCY CERTIFICATE FOR A COMPANY

Why should I obtain a Tax Residency Certificate for my UAE company? Tax Residency Certificates are crucial in substantiating your UAE company’s tax residence in the UAE. They are particularly important where the shareholders and / or directors of the company have a non-UAE connection or international tax exposures, and in certain circumstances can be … Read more OBTAINING TAX RESIDENCY CERTIFICATE FOR A COMPANY

RECENT DEVELOPMENT IN UAE VAT LAW

One of our resident VAT experts, Sudarshan speaks about the new guidelines and clarifications published by the FTA during last few months at IFA Dubai Branch Meeting on December 22,2018. He highlighted the seriousness of proper tax compliance and recordkeeping requirement to avoid unnecessary penalties by the FTA.

VAT: IMPACT ON BUSINESSES IN BAHRAIN

One of our resident VAT experts, Adnan speaks about how VAT can have an impact on businesses in Bahrain by highlighting the following key points:- Impact on Revenue Procurement and Input Tax Contracts & Policies Record Keeping, IT & ERP Systems Compliances He also emphasized that Affiniax can help in the following ways :- VAT … Read more VAT: IMPACT ON BUSINESSES IN BAHRAIN

BAHRAIN VAT: LARGE FIRMS TO REGISTER BEFORE JANUARY 1, 2019

As part of the first phase of VAT registrations, the Ministry of Finance in Bahrain has announced that companies with taxable revenue exceeding BHD5M per annum are required to register by 20th December 2018. The effective date of registration will be 01st January 2019. It is not clear whether applications received on or after 20th December 2018 ... Read more BAHRAIN VAT: LARGE FIRMS TO REGISTER BEFORE JANUARY 1, 2019

VAT IN UNITED ARAB EMIRATES: PROFIT MARGIN SCHEME

The Federal Tax Authority (‘’FTA’’) issued a public clarification on Article 29 (VATP002) of the Executive Regulation of the Federal Decree-Law No. (8) of 2017 on Value Added Tax, few months ago. This has been further clarified by the FTA at an awareness session recently organised at the Abu Dhabi Chamber of Commerce and Industry in … Read more VAT IN UNITED ARAB EMIRATES: PROFIT MARGIN SCHEME

9 KEY POINTS TO BECOMING A PROACTIVE ACCOUNTANT

As a business owner we often feel if we had that something extra, something better and something clearer to take an informed decision. And that ‘SOMETHING’ often depends on the proactive approach from your Accountant. As a business owner and as a Chartered Accountant, I understand the limitations that we come across at both ends. Our ... Read more 9 KEY POINTS TO BECOMING A PROACTIVE ACCOUNTANT

UAE FOREIGN INVESTMENT LAW CHANGE

The UAE Government has now enacted Federal Decree-Law No. 19 of 2018 (“FDI Law”) in furtherance of its objective to allow increased foreign shareholder participation in UAE mainland registered companies beyond the current restriction of 49%. To date, foreign investors wanting to own UAE businesses wholly, or to have a majority stake, have been limited to registering … Read more UAE FOREIGN INVESTMENT LAW CHANGE

VAT IN UNITED ARAB EMIRATES: WHAT IS IT AND WHAT ARE THE IMPACTS?

Why is VAT being introduced? The Ministry of Finance and the wider GCC have agreed to implement Value added tax (VAT) at a rate of 5% from 1 January 2018. This landmark Agreement marks the start of a fiscal reform across the region. The increased need to diversify the economy, changing operating models and promoting … Read more VAT IN UNITED ARAB EMIRATES: WHAT IS IT AND WHAT ARE THE IMPACTS?

BAHRAIN VAT: IN COMPARISON

The government of Bahrain has announced the implementation of VAT from 1st January 2019. An Arabic version of the VAT law has been published. Implementing regulations will be released at a later date which will explain the VAT matters in further detail. Some of the important points and differences to UAE and KSA VAT legislation are … Read more BAHRAIN VAT: IN COMPARISON

TRANSFORMING HR AND STRATEGIZING CHANGE MANAGEMENT

We were recently honored with “Mark of Excellence” for “Best HR Transformation & Change Management Strategy” at the Future Workplace Awards on November 13, 2018 at Park Hyatt, Dubai. The initiative to transform the HR practices at our workplace was rolled in the last quarter of 2017 by our leadership team with the goals of improving ... Read more TRANSFORMING HR AND STRATEGIZING CHANGE MANAGEMENT

KSA VAT: WHAT ARE ZERO RATED SERVICES AND HOW CAN I ENSURE THAT I AM NOT CHARGING TOO MUCH TAX?

The tax treatment of services provided by registrants under the UAE VAT and KSA VAT legislation is often a complex area, with both sets of tax laws providing strict rules on when such services can be subject to the zero rate of VAT. In KSA, in particular, the law requires suppliers to assess a number of factors … Read more KSA VAT: WHAT ARE ZERO RATED SERVICES AND HOW CAN I ENSURE THAT I AM NOT CHARGING TOO MUCH TAX?

UAE VAT AND THE EXCHANGE RATE, HOW DOES TAX AFFECT CURRENCY EXCHANGES AND YOUR BUSINESS?

The Federal Tax Authority ("FTA") published Article 69 in April 2018, of Federal Decree-Law no. (8) of 2017 for the clarification of Currency Exchange rate for VAT purposes with effect from 17 May 2018. When a supply is made in any currency other than AED all taxable persons must use the Central Bank's published exchange ... Read more UAE VAT AND THE EXCHANGE RATE, HOW DOES TAX AFFECT CURRENCY EXCHANGES AND YOUR BUSINESS?

UAE VAT: WHAT ARE DESIGNATED ZONES AND WHAT DOES IT MEAN TO MY BUSINESS?

Under the VAT guide on Designated Zones (“DZs”) the Federal Tax Authority (“FTA”) has confirmed the VAT treatment applicable to businesses operating in DZs as provided for in the VAT Law and Executive regulations, and clarified the treatment of supplies in specific cases where previously there was some ambiguity. The key noteworthy clarifications are: If … Read more UAE VAT: WHAT ARE DESIGNATED ZONES AND WHAT DOES IT MEAN TO MY BUSINESS?

UNDERSTANDING VAT ON ENTERTAINMENT EXPENSES

The Federal Tax Authority (“FTA”) issued a Public Clarification Article 52 of Cabinet Decision no. (52) of 2017 on the Executive Regulation of the Federal Decree-Law No. (8) of 2017 on VAT. Entertainment has been defined as hospitality of any kind, including the provision of accommodation, food and drinks not provided in the normal course … Read more UNDERSTANDING VAT ON ENTERTAINMENT EXPENSES

THE VALUE OF BUSINESS CONSULTING IN THE UAE?

Determining the value you can derive from business consulting is one of those things that often comes with hindsight and, on occasion is overlooked or missed entirely. Having expert specialist advise or guidance often leads to the right decisions being made on a day to day basis and that can be mistaken for ‘business as usual’ rather … Read more THE VALUE OF BUSINESS CONSULTING IN THE UAE?

HOW MUCH DOES AN ACCOUNTANT COST IN DUBAI?

The recent changes in the business world in the UAE, particularly the introduction in VAT, has seen significantly increased demand for accountancy services. Until recently, many small and medium businesses may not have had their financial statements professionally compiled or audited whereas newer regulations have made this a necessity rather than something that was done for a ... Read more HOW MUCH DOES AN ACCOUNTANT COST IN DUBAI?

WHAT IS THE COST OF OUTSOURCING THE ACCOUNTING AND FINANCE FUNCTION / DEPARTMENT?

Understanding the cost of outsourcing can be confusing. In a field where there are so many options, it is difficult to determine the cost of the accounts and what actually defines this outgoing. Here are six factors that can help you determine the cost of an accountant and why. 1) TRANSACTIONS On a pure labor ... Read more WHAT IS THE COST OF OUTSOURCING THE ACCOUNTING AND FINANCE FUNCTION / DEPARTMENT?

5 THINGS YOU MUST CONSIDER WHEN SETTING UP A BUSINESS IN DUBAI

Forming the business model It is imperative to understand the model of your business before taking the plunge into entrepreneurship. Often companies have been formed where the owner has a great idea but forget that an elegant solution doesn’t automatically translate into a successful business. Companies require an appropriate and effective business model, with the ... Read more 5 THINGS YOU MUST CONSIDER WHEN SETTING UP A BUSINESS IN DUBAI

The Trends changing the Business Landscape and the Role of the Board

I recently had an opportunity to attend a seminar by the Australian Institute of Company Directors (AICD) on how the business landscape is changing and the vital role of the Board in ensuring that their respective organizations are ready to embrace such change. I was pleasantly surprised to observe that the discussion on the "Role ... Read more The Trends changing the Business Landscape and the Role of the Board

IS THERE A LINK BETWEEN A CORPORATE CULTURE BASED ON SHARED VISION AND VALUES AND ORGANISATIONAL PERFORMANCE?

I have been pondering over this question for many years and now believe that more and more companies are beginning to recognize the importance of strong corporate culture based on shared vision and values of all stakeholders (more importantly of their own employees) in achieving the bottom line. Even though the idea of vision and … Read more IS THERE A LINK BETWEEN A CORPORATE CULTURE BASED ON SHARED VISION AND VALUES AND ORGANISATIONAL PERFORMANCE?

Business Set Up with International Free Zone Authority (IFZA), Fujairah

International Free Zone Authority or IFZA is a newly launched free zone located in the heart of Fujairah. Fujairah is one of the seven emirates of the United Arab Emirates and it lies in the eastern side of UAE that has a coastline solely on the Gulf of Oman. IFZA is set to quickly become a … Read more Business Set Up with International Free Zone Authority (IFZA), Fujairah